CFP® vs. CPWA®: What’s the Difference in Serving High-Net-Worth Clients?

Sep 15, 2025 9:00:00 AM

.

.

It's true: Clients with a net worth of $5 million+ represent career-changing opportunities for advisors and advisory teams. But only for those professionals who have the skills, training, and education to win their business and successfully serve their unique needs. Transitioning yourself into a bona fide high-net-worth (HNW) financial advisor requires a quantum leap of professional growth, even for experienced CFP® practitioners. Many CFP® professionals are looking for the pathway to achieve that next level of sophistication and success.

.

While the CFP® credential provides a popular, solid foundation in broad-based financial planning, CPWA® professionals attain an unmatched level of technical fluency — laser-focused wealth management capabilities that are tailored to the needs of HNW clients. By gaining advanced knowledge in areas that include tax-efficient wealth structuring, alternative investments, family governance, legacy planning, and many others, CPWA® practitioners are able to produce customized, holistic solutions well beyond the scope of standard financial plans.

.

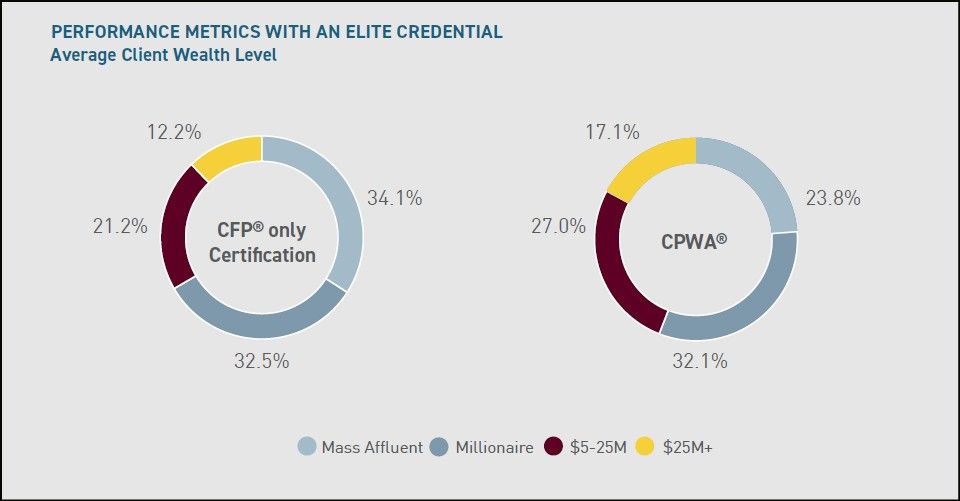

Research attests to these advantages: CPWA® advisors are more likely to serve wealthier clients and have larger amounts of assets under management than their CFP® only peers. On average, 44.1% of CPWA-certified advisors’ clients are either HNW or $25 million+ clients. This compares to just 33.4% of the average CFP® only professional’s book. Looking specifically at clients with $25 million or more in investable assets, CPWA® certified advisors report that this ultra-high-net-worth segment comprises an average of 17.1% of their client base — compared to an average of 12.2% among CFP® professionals who have not pursued the CPWA® designation or other advanced certification through the Institute.

.

The advanced skills and training CPWA® practitioners acquire help them anticipate complex challenges — such as multigenerational wealth transfer, concentrated stock positions, or the tax impact of executive compensation — and allows them to provide premier guidance that consistently strengthens client trust and loyalty.

.

What Are the Basic Differences Between Mass-Affluent Clients and HNW Clients?

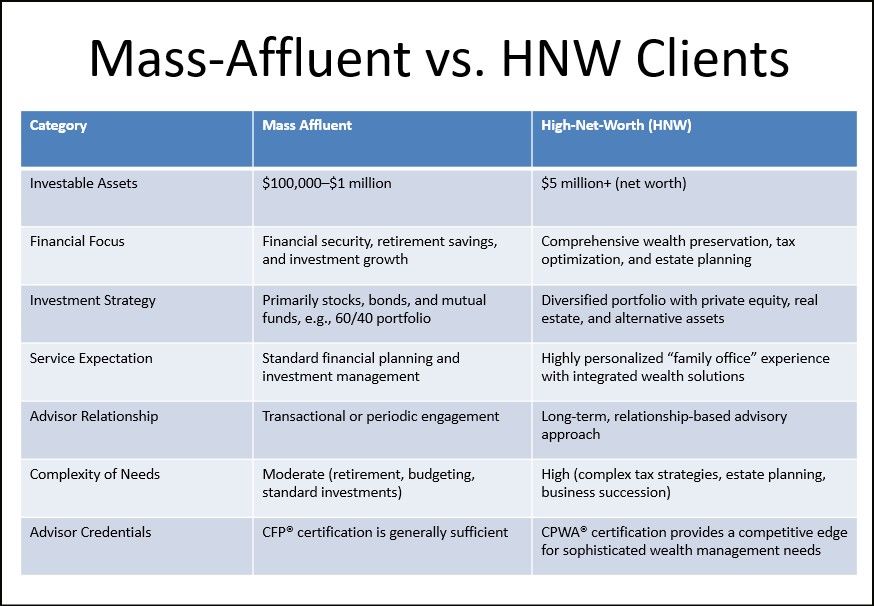

Mass-affluent clients tend to need traditional financial planning services, such as budgeting, debt management, and basic investment strategies centered around diversified stock and bond portfolios (often following the classic 60/40 asset allocation model). While they value professional guidance, their service expectations are generally standardized, with periodic check-ins rather than an ongoing, high-touch advisory relationship. Their investment preferences tend to be more conservative, prioritizing long-term growth and risk mitigation over alternative or complex asset classes.

.

The HNW echelon of clients, however, has complex financial needs that require a sophisticated and highly personalized approach. These individuals, with minimum net-worth of $5 million, $25 million, or even more, expect an elevated level of service that integrates financial well-being with a variety of lifestyle services and multigenerational wealth planning. Their investment portfolios incorporate alternative assets, private equity, and real estate. They seek rewarding, long-term relationships with advisors who are among the highest qualified and most distinguished.

.

If you put in the work to meet these criteria, you can position yourself to become a trusted partner in managing and preserving your clients’ wealth now and across future generations. Remember, HNW individuals expect more than transactional advice. They seek a holistic, consultative relationship tailored to their unique needs and aspirations.

.

It’s Time – Become the Advisor HNW Clients Are Already Looking For

If you are a CFP® professional who is ready to make a transformative investment in your career, pursuing advanced education is not just a smart move — it’s a strategic imperative. You simply must acquire the skills and aptitudes necessary to serve HNW individuals and families. The Certified Private Wealth Advisor® (CPWA®) certification program delivers exactly that. Earning the CPWA® designation signals to clients, peers, and the whole financial industry that you possess advanced acumen, judgment, and the distinct skill sets that are required to deliver elite guidance on topics unique to HNW clientele.

.

By delivering a comprehensive education on advanced wealth management strategies, the CPWA® program gives you the tools you need to deliver exceptional value to your HNW and UHNW client relationships. By integrating a holistic approach with deep and focused expertise, CPWA® certification holders have reported greater career satisfaction and higher compensation than non-holders. For example:

73% of CPWA® professionals manage more than 50% of their clients’ investable assets and are more likely to manage $1B+ in assets.

93.3% of CPWA® advisors rate the certification as highly valuable.

67.1% of CPWA® professionals are adept at implementing family governance and educational programs.

$682K is the average annual earnings for CPWA® advisors.

To learn more about the CPWA® designation, please visit our CPWA® Overview webpage and read our complimentary ebook, “How CFP® Professionals Can Enhance Their Expertise & Serve Wealthier Clients.”