How CFP® Professionals Can Reach the Next Level: Insights from Industry Research

Oct 6, 2025 8:00:00 AM

A shift in clientele can provide substantial career reward with significantly increased financial compensation.

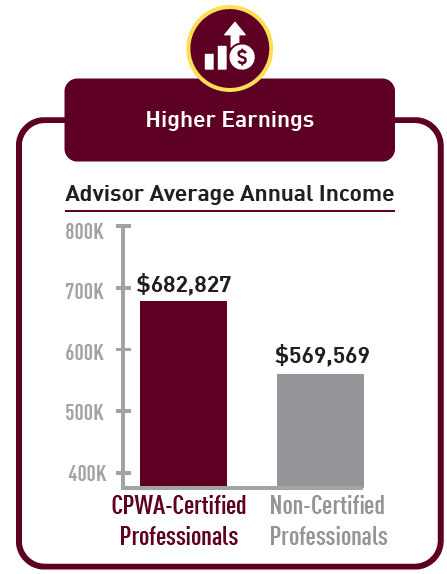

A 2025 study by CEG Insights found that Certified Professional Wealth Advisor® (CPWA®) professionals earn approximately 20% more annually than advisors without Institute certifications. That’s largely because, on average, 44.1% of clients served by professionals holding the CPWA® designation are either high-net-worth (HNW) or $25 million+ clients. This compares to just 33.4% of such clients served by professionals who hold only the CFP® certification.

This performance gap speaks to the benefits of acquiring advanced knowledge, skills, and the professional mindset necessary to win the business of premium clients. Experienced wealth managers who have already earned Certified Financial Planner® (CFP®) certification can travel a similar path by earning additional, specialized credentials — designed specifically for successfully serving HNW clients and their unique needs.

.

The difference is in knowledge and services

Mass-affluent clients tend to need traditional financial planning services, such as budgeting, debt management, and basic investment strategies centered around diversified stock and bond portfolios, often following the classic 60/40 asset allocation model.

By contrast, high-net-worth clients have more complex situations requiring a sophisticated, personalized approach. These individuals expect an elevated level of service that integrates financial well-being with a variety of lifestyle services and multigenerational wealth planning. Their investment portfolios incorporate a range of alternative assets, including private equity and real estate. They seek rewarding, long-term relationships with advisors who are among the highest qualified and most distinguished.

The market is large, but the competition is fierce

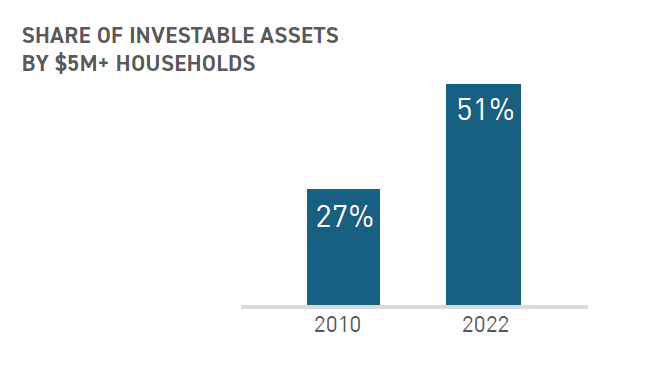

As of 2023, households with a net worth of more than $5 million controlled 51% of investable assets in the United States. By 2024, there were more than 900,000 households in the U.S. with more than $10 million in assets. And most recently, the 2025 USA Wealth Report from Henley & Partners and New World Health found there are six million HNW individuals with investable wealth of $1 million or more.

Wealthy individuals and families can select discerningly and carefully choose whom they want to work with, benefiting from many highly qualified firms and wealth managers vying for their business. To differentiate yourself in this environment, you’ll need a unique calling card that showcases your professional pedigree.

This is where an advanced professional credential, such as the Certified Private Wealth Advisor® (CPWA®) certification, becomes a powerful advantage. To stand out and stay ahead, you’ll need to offer a variety of lifestyle services and multigenerational wealth planning. Your portfolios must deftly incorporate alternative assets, such as private credit, infrastructure, and hedge fund strategies. Often, the difference between a qualified advisor and an extraordinary, certified advisor is not just familiarity, but the depth of knowledge you bring to specialties like alternative investments, tax strategies, estate planning, or family governance.

The CPWA® certification program is designed for advisors serving HNW clients with a minimum net worth of $5 million, $25 million, or more. It addresses both technical fluency and the ability to articulate your own value. Earning this certification will empower you to move beyond broad recommendations and engage in precise, client-specific analysis. You’ll develop the ability to:

Model opportunities — such as tax-efficient business exits, charitable trusts, or equity compensation strategies for executives.

Apply and interpret regulations — navigating estate tax law changes or critical rules affecting sophisticated investment vehicles.

Analyze, calculate, and estimate value — for private business interests, concentrated stock positions, or complex retirement income strategies.

Identify, determine, and evaluate risks — including alternative investments, tax exposure, and behavioral biases within family decision-making.

Differentiate and compare scenarios — to present clearly reasoned options and guide clients through trade-off decisions.

These capabilities give you the confidence to lead high-stakes conversations featuring customized wealth strategies. CPWA® certification program also provides the behavioral finance expertise you to address your clients' emotional twists and turns – and examine your own advice.

The prerequisites for the CPWA® program ensure that only the most capable and committed advisors qualify to pursue the designation — ensuring recipients are truly among the financial industry's most distinguished wealth advisors. To ensure candidates have the knowledge and experience to dig deep into the CPWA® Body of Knowledge, enrollment requirements include a bachelor’s degrees or other wealth certifications, background checks, and at least five years of experience in the financial field.

Your mindset matters

When serving mass-affluent clients, many advisors inadvertently limit their own practice and career growth. There are several key reasons for this.

Limited revenue potential from less complex financial needs and smaller investable assets, which necessarily limit the advisor’s fees and revenue.

A resource-intensive service model of serving higher volumes of clients requires more time and resources for the revenue and tighter profit margins.

Competitive market saturation that makes it difficult to stand out and vie for new clients.

Restricted bandwidth to develop specialization. Busy advisors can be hard-pressed to develop niche expertise that could command more premium fees.

Career advancement constraints. Many firms rely on senior advisors who have already attracted and retained HNW clients, potentially limiting career progression for others, unless you can prove your deeper knowledge and savvy insight.

The curriculum is here; the commitment and future are yours.

Take a moment to consider your future as a financial professional. One scenario is if you earn an additional, premier certification featuring sophisticated wealth management knowledge and skills — the other one is where you do not. Both scenarios deserve serious, well-informed consideration.

By downloading the Institute’s new ebook, HOW CFP® PROFESSIONALS CAN ENHANCE THEIR EXPERTISE & SERVE WEALTHIER CLIENTS, you can learn about the benefits, specific curriculum and commitment required to pursue the first option, and become a trusted partner to lucrative, HNW clients. This is the future where you are able to navigate financial complexity with clarity, provide safety in a risky, uncertain world, and help create a lasting impact for HNW families and their larger interests. It’s time to open the door to a quantum leap of professional growth.